The very term continues to evoke affection, envy, and in the hearts of lots of public business CEOs fear. In the last few years, private equity companies have pocketed huge and controversial sums, while stalking ever larger acquisition targets. Certainly, the worldwide value of private equity buyouts larger than $1 billion grew from $28 billion in 2000 to $502 billion in 2006, according to Dealogic, a firm that tracks acquisitions.

Private equity firms’ track record for dramatically increasing the value of their investments has actually assisted fuel this growth. Their capability to attain high returns is usually attributed to a variety of elements: high-powered rewards both for private equity portfolio supervisors and for the operating managers of services in the portfolio; the aggressive use of debt, which supplies financing and tax advantages; an identified concentrate on capital and margin improvement; and flexibility from limiting public business guidelines. conspiracy commit securities.

That technique, which embodies a mix of service and investment-portfolio management, is at the core of private equity’s success. Public companieswhich inevitably acquire businesses with the objective of hanging on to them and incorporating them into their operationscan successfully discover or obtain from this buy-to-sell approach. To do so, they first need to understand just how private equity firms utilize it so effectively.

It does not make sense when a gotten service will benefit from important synergies with the purchaser’s existing portfolio of organisations. It definitely isn’t the way for a business to make money from an acquisition whose main appeal is its prospects for long-lasting organic development. Nevertheless, as private equity firms have actually shown, the method is ideally suited when, in order to understand an one-time, short- to medium-term value-creation opportunity, buyers need to take straight-out ownership and control.

It can also be discovered with organisations that are undervalued because their potential isn’t easily apparent. In those cases, once the changes essential to attain the uplift in value have been madeusually over a duration of 2 to six yearsit makes good sense for the owner to sell business and proceed to new opportunities.

Specific funds can have their own timelines, financial investment objectives, and management philosophies that separate them from other funds held within the same, overarching management firm. Effective private equity companies will raise lots of funds over their life time, and as firms grow in size and intricacy, their funds can grow in frequency, scale and even uniqueness. For more information about real estate investing and also - visit his blogs and -.

In 15 years of handling properties and backing a number of entrepreneurs and financiers,Tysdal’s business co-managed or handled , non-discretionary, approximately $1.7 billion in assets for ultra-wealthy families in industries such as gas, health care and oil , real estate, sports and home entertainment, specialty loaning, spirits, innovation, durable goods, water, and services business. His team suggested clients to buy nearly 100 entrepreneurial business, funds, private financing deals, and real estate. Ty’s track record with the private equity capital he deployed under the first billionaire client was over 100% annual returns. And that was throughout the Great Recession of 2008-2010 which was long after the Carter administration. He has actually created hundreds of millions in wealth for customers. Nevertheless, offered his lessons from dealing with a handful of the accredited, extremely sophisticated individuals who might not appear to be pleased on the advantage or comprehend the potential drawback of a offer, he is back to work entirely with entrepreneurs to help them sell their business.

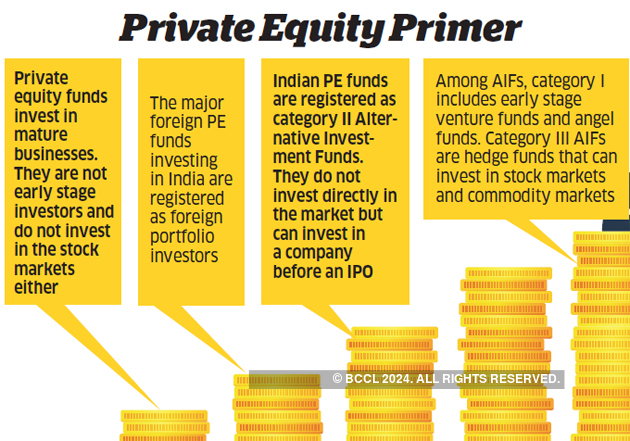

Private equity firms raise funds from institutions and rich individuals and after that invest that money in trading businesses. After raising a specified quantity, a fund will near new investors; each fund is liquidated, offering all its services, within a predetermined amount of time, typically no more than 10 years. commit securities fraud.

Private equity companies accept some restrictions on their use of investors’ cash. A fund management contract might restrict, for instance, the size of any single business financial investment. As soon as cash is devoted, however, investorsin contrast to shareholders in a public companyhave almost no control over management (million investors state). Although the majority of companies have a financier advisory council, it has far fewer powers than a public company’s board of directors.

Private Equity, Not Delivering What They Promise?

Instead, private equity companies exercise control over portfolio business through their representation on the companies’ boards of directors. Generally, private equity firms ask the CEO and other leading operating managers of a company in their portfolios to personally purchase it as a way to guarantee their commitment and inspiration.

In accordance with this model, operating supervisors in portfolio businesses typically have greater autonomy than unit supervisors in a public business. Although private equity companies are beginning to establish operating skills of their own and thus are now more likely to take an active role in the management of an acquired service, the conventional model in which private equity owners offer suggestions but do not intervene straight in day-to-day operations still dominates.

Fund earnings are primarily understood by means of capital gains on the sale of portfolio organisations. Due to the fact that financing acquisitions with high levels of debt enhances returns and covers private equity companies’ high management fees, buyout funds look for out acquisitions for which high financial obligation makes sense. denver district court. To ensure they can pay financing expenses, they try to find steady capital, limited capital investment requirements, at least modest future growth, and, above all, the chance to improve efficiency in the short to medium term.

In some countriesparticularly the United Statesthat provides crucial tax and regulative benefits over public business. The advantages of purchasing to sell in such scenarios are plainthough, again, frequently neglected. Think about an acquisition that rapidly increases in valuegenerating a yearly investor return of, say, 25% a year for the very first 3 yearsbut subsequently makes a more modest if still healthy return of, state, 12% a year.

A diversified public company that attains identical operational efficiency with the obtained businessbut, as is common, has bought it as a long-term investmentwill make a return that gets closer to 12% the longer it owns business. For the general public business, hanging on to the company once the value-creating changes have been made waters down the last return.

Under their previous owners, those businesses had actually frequently suffered from disregard, inappropriate performance targets, or other restraints. Even if well handled, such companies may have did not have an independent performance history because the parent business had actually incorporated their operations with those of other units, making business hard to value. Sales by public companies of unwanted company units were the most crucial classification of big private equity buyouts till 2004, according to Dealogic, and the leading companies’ extensively appreciated history of high financial investment returns comes mainly from acquisitions of this type.

( See the display “Private Equity’s New Focus.”) This has actually produced new obstacles for private equity firms. In public business, easily realized improvements in performance frequently have currently been accomplished through better business governance or the advocacy of hedge funds. For example, a hedge fund with a significant stake in a public company can, without having to buy the company outright, pressure the board into making important modifications such as offering unnecessary properties or spinning off a noncore system.

Public Versus Private Equity

When KKR and GS Capital Partners, the private equity arm of Goldman Sachs, got the Wincor Nixdorf system from Siemens in 1999, they were able to deal with the incumbent management and follow its strategy to grow earnings and margins. In contrast, considering that taking Toys “R” Us private in 2005, KKR, Bain Capital, and Vornado Real Estate Trust have needed to change the whole leading management group and establish an entire brand-new strategy for the organisation.

And it may become harder for firms to squander of their investments by taking them public; offered the current high volume of buyouts, the number of large IPOs could strain the stock markets’ capability to absorb brand-new problems in a few years. Even if the current private equity financial investment wave declines, though, the unique advantages of the buy-to-sell approachand the lessons it uses public companieswill stay – state prosecutors mislead.

In contrast, an organisation system that has been part of a public company’s portfolio for some time and has carried out sufficiently, if not spectacularly, generally does not get concern attention from senior management. In addition, because every financial investment made by a private equity fund in a business should be liquidated within the life of the fund, it is possible to specifically determine money returns on those investments (partner grant carter).